By: Bart Baesens, Seppe vanden Broucke

This QA first appeared in Data Science Briefings, the DataMiningApps newsletter as a “Free Tweet Consulting Experience” — where we answer a data science or analytics question of 140 characters maximum. Also want to submit your question? Just Tweet us @DataMiningApps. Want to remain anonymous? Then send us a direct message and we’ll keep all your details private. Subscribe now for free if you want to be the first to receive our articles and stay up to data on data science news, or follow us @DataMiningApps.

You asked: What is the shadow rating approach in a corporate credit risk modeling context?

Our answer:

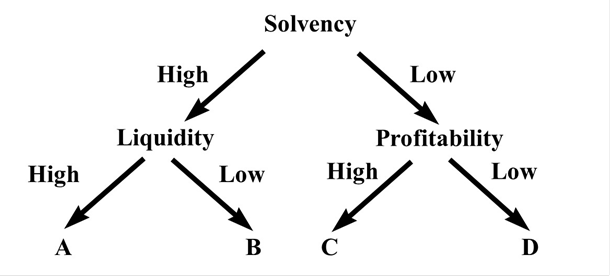

The shadow ratings approach starts from a data set with ratings for a particular set of “obligors”. In a next step, information will be collected for each obligor which might have an influence on the rating. Example data which can be considered in a corporate setting are accounting ratios, firm characteristics, and stock price behavior. The aim is then to combine all this information in one data set (see the table below) and build an analytical model to predict the ratings. The below figure shows an example of a decision tree predicting ratings. The advantage of this approach is that we obtain a white box understandable model which clearly indicates how the various characteristics of an obligor contribute to the rating. It will also provide clear advice to corporates on how to improve their rating. Furthermore, in the long term, this approach allows the bank to become independent from the rating agency, since the internal statistical model can now be used to rate any obligor given its characteristics.

| Company | Solvency | Liquidity | Stock price | … | Rating |

| ABC | 10% | 66% | 100 | B | |

| CDE | 5% | 90% | 16 | A | |

| DEF | 78% | 12% | 225 | A | |

| FGH | 24% | 58% | 88 | C | |

| … |